In the News: Findings in National Financial Literacy Report Card Make Headlines

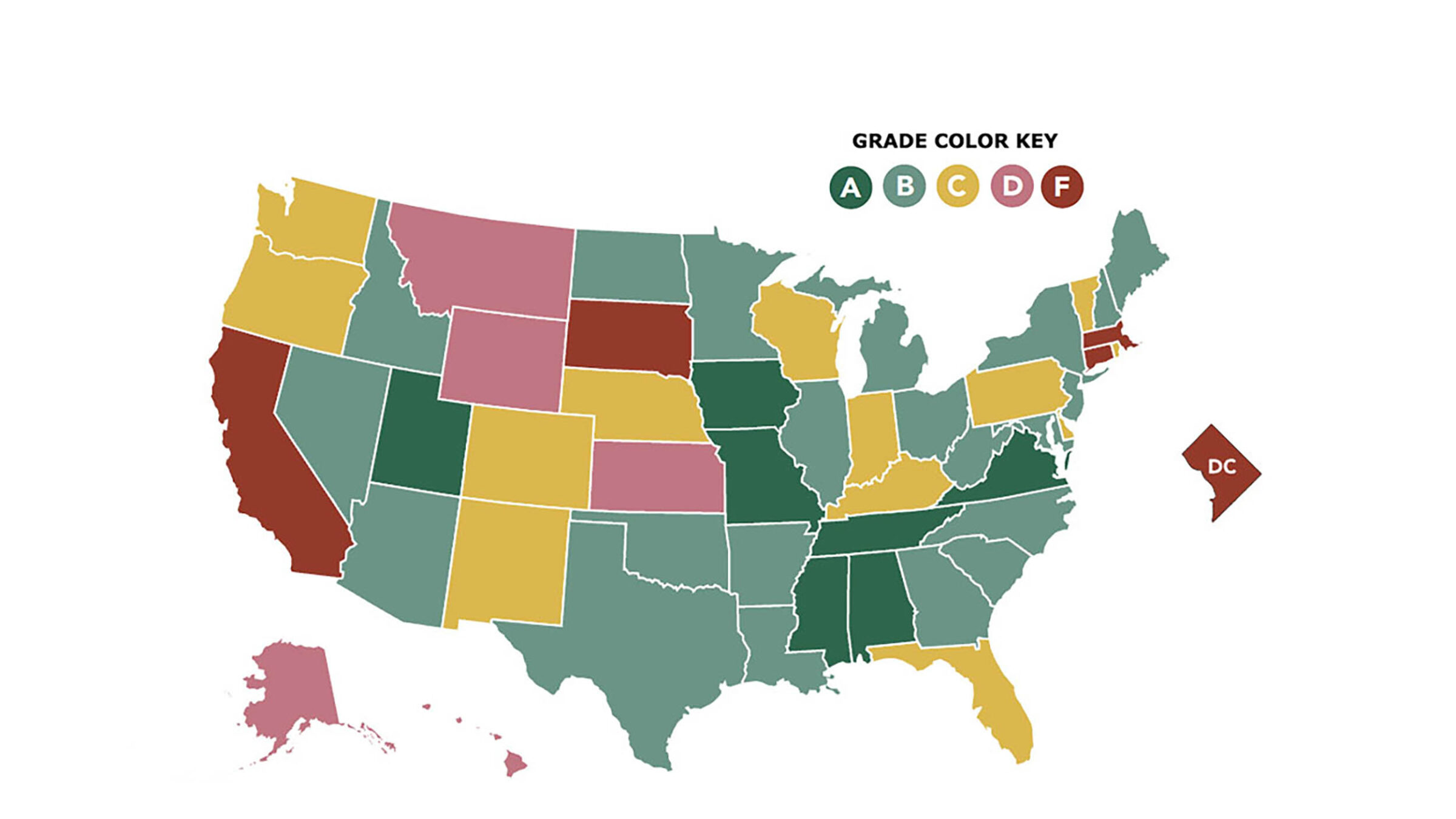

Champlain College’s Center for Financial Literacy released its fourth National Report Card on State Efforts to Improve Financial Literacy in High Schools. The new report shows significant progress toward the goal of having every high school student in America guaranteed a semester-long course in personal finance prior to graduation, and it promises huge gains in many states over the next five years.

The New York Times first published a story on Friday, December 1, about the research center’s findings, which you can read here. CNBC’s “Squawk Box” also covered the new findings on December 4.

John Pelletier, director of the Center, says that the 2023 report card lists seven states earning an A, just two more states than in 2017, its last report card. The seven states are Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah, and Virginia. States with an A grade require students to take a semester long personal finance course, or its equivalent, prior to graduation.

“This doesn’t seem like much growth, but sometimes statistics mask reality,” says Pelletier. “Tremendous change is on the horizon. States are rapidly passing laws and changing regulations, and we estimate that, assuming full implementation of legislation and policies, we will have 23 grade A states by 2028.”

For the first time ever, the report card also includes a section addressing racial equity and how implementing, at the state level, personal finance courses in high schools could improve the racial wealth gap in America. “All too often, students from underprivileged backgrounds enter adulthood with insufficient knowledge of personal finance, which continues the cycle of poverty and inequality,” the report says.

“No state in the nation had this requirement when the Class of 2007 graduated. When the Class of 2028 graduates, 41 out of 100 students will live in a state with such a requirement,” he says.

Pelletier says legislators are responding to families who didn’t have financial safety nets during the pandemic, as well as to advocacy by educators, administrators, parents and students. He also notes that there is a recognition that personal finance knowledge and skills are crucial in today’s complex financial world, and cites the expanding availability of free online curricular resources offered by state departments of education and by non-profit organizations.

Of the 23 states projected to earn As by 2028, nine will rise from a B grade, five will improve from a C, one from a D and one from an F. The Center projects that the number of states getting a C, D or F will drop from 23 in the current report card to 14 by 2028.

“Our nation will need about 30,000 highly trained high school educators to teach personal finance in grade A and B states by 2028,” say Pelletier. “There is a need to provide these educators substantive personal finance education right now.”

To help bridge that gap, the Center for Financial Literacy offers training through graduate courses, free professional development programming, and other resources for teachers. Click here to learn more about introducing personal finance courses into high school curricula.

Keep up with further coverage and insights about the report by national media here.

Did you know: All Champlain College students graduate with personal finance education through the InSight program.

A low-pressure experience, the Game of Life offers students insight into what their financial futures could look like after graduation, including how student loan payments factor in to daily decision making.

At Champlain College, quality personal finance education is an essential and mandatory part of each student’s curriculum, incorporated through the college’s unique InSight program—a four-year career, personal finance, and wellbeing curriculum that’s overseen by Champlain’s Career Collaborative. InSight teaches students skills and strategies to position themselves in their careers and manage their personal finances and wellbeing. The Game of Life event for first-year students challenges them to a budgeting simulation with an assigned salary based on their majors. Read more about the annual Game of Life event.

Author

More Inside The View

Ideas

From the minds of our students, faculty, and alumni.

News

The latest from Champlain College.

People

Champlain is more than just a place; it's a community.

Places

On campus, in Burlington, and beyond.

Events

Check out our many campus events and get involved! Refine your search by using the filters or monthly view options.